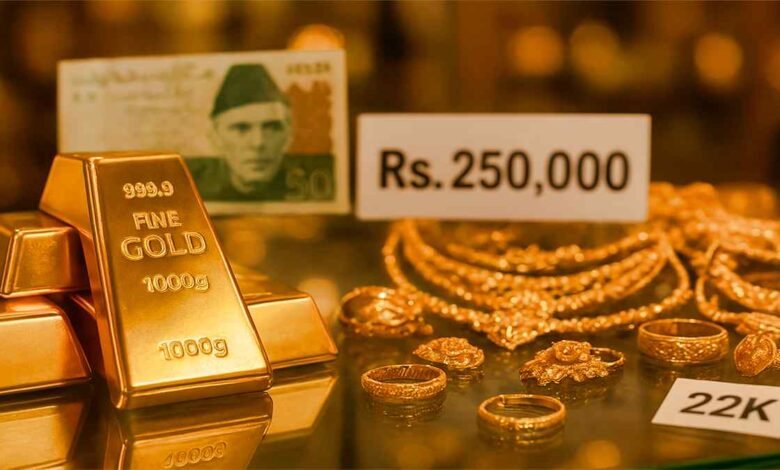

A Significant Increase in Gold Prices Was Recorded in Pakistan

Gold prices in Pakistan have recently witnessed an extraordinary surge, reaching record highs across major cities. This development has sparked widespread discussions among investors, jewelers, and consumers who rely on gold for both investment and cultural purposes.

Let’s explore what’s driving this sharp increase, how it affects the local economy, and what experts predict for the future of gold prices in Pakistan.

1. Understanding the Current Surge in Gold Prices

In October 2025, gold prices in Pakistan soared to Rs. 250,000 per tola for 24-karat gold, the highest ever recorded. According to the All Pakistan Gems and Jewellers Association (APGJA), prices rose by more than Rs. 6,000 in a single week, a jump that took both traders and customers by surprise.

This steep rise reflects broader global economic challenges, as well as local currency depreciation. For many, gold remains a dependable way to secure wealth during uncertain times, but the rapid increase has made it difficult for ordinary citizens to afford even basic jewelry.

2. Global Trends Behind the Gold Price Hike

The surge in gold prices in Pakistan is closely linked to international market behavior. Globally, gold is trading above $2,500 per ounce, driven by economic and geopolitical uncertainty.

When global inflation rises or when investors lose faith in stock markets, they often turn to gold as a safe-haven asset. Recently, tensions in global trade, rising oil prices, and slowing economic growth have all pushed investors toward gold.

Since Pakistan imports most of its gold, these global price movements directly impact the local market, amplifying costs for consumers and traders alike.

3. The Pakistani Rupee’s Decline and Its Impact

A major factor contributing to high gold prices is the depreciation of the Pakistani rupee against the U.S. dollar. Over the past year, the rupee has weakened considerably, making imported commodities like gold more expensive.

Even if the international gold price remains stable, a weaker rupee automatically increases gold prices in Pakistan. Experts estimate that for every 1% decline in the rupee, domestic gold prices may rise by 2–3%, depending on global demand and import costs.

4. Inflation and Economic Uncertainty: Gold as a Safe Investment

With inflation hitting record levels, many Pakistanis are turning to gold as a secure investment option. Unlike currency or stocks, gold maintains its value over time, even during economic turbulence.

People prefer gold because it:

- Protects savings from inflation.

- Offers liquidity it can be easily sold anywhere.

- Serves as a long-term store of value.

This growing demand, however, pushes prices even higher. As more individuals rush to buy gold, its market value continues to climb, creating a cycle of rising demand and limited supply.

5. Impact on Consumers and Local Businesses

While investors may benefit from rising prices, ordinary consumers and small jewelry businesses are struggling. Many families, particularly those planning weddings, are forced to scale down gold purchases or switch to silver jewelry.

A Lahore-based jeweler shared:

“Customers now prefer lighter sets or gold-plated options. Traditional heavy sets have become unaffordable for middle-income families.”

For small gold traders, high prices mean reduced sales and tighter cash flow. Rural communities, where gold is a form of saving, are also feeling the strain.

6. Expert Insights on the Future of Gold Prices in Pakistan

Economic experts believe that the surge in gold prices is likely to continue unless the rupee strengthens and global market volatility stabilizes.

According to Dr. Khurram Shehzad, a renowned financial analyst,

“The rise in gold prices reflects deeper economic challenges currency depreciation, high import costs, and low investor confidence. Pakistan’s gold market may remain volatile for several months.”

This suggests that investors should tread carefully and stay informed before making large purchases.

7. Investment Advice: Navigating the Golden Opportunity

For those considering gold investments, experts recommend a balanced approach:

- Avoid panic buying. Wait for market corrections before making big purchases.

- Diversify. Don’t rely solely on gold; explore other investment options.

- Use digital gold platforms. They offer convenience and safety without physical handling risks.

Investors should also track daily gold rates in Pakistan through reliable sources to make informed decisions.

8. Conclusion: Gold Reflects Pakistan’s Economic Pulse

The significant rise in gold prices in Pakistan is not just a local phenomenon it mirrors global financial uncertainty and domestic economic challenges.

While this surge benefits long-term investors, it creates difficulties for households and small businesses. As Pakistan continues to navigate inflation, currency devaluation, and shifting global trends, gold remains both a symbol of stability and a measure of economic stress.

For now, one truth remains, gold continues to shine brightly, but at a price that few can easily afford.

4 Comments