Gold Prices in Pakistan Hit Record Highs 2025

A Significant Increase in Gold Prices Was Recorded in Pakistan

Gold has always held a special place in Pakistan’s culture and economy from bridal jewelry to long-term investments. However, in recent months, Pakistan has witnessed a sharp and sustained increase in gold prices, sparking concern and curiosity among traders, investors, and ordinary citizens alike.

This article explores why gold prices are rising so rapidly, the factors driving this surge, and how it is affecting the broader economy and public sentiment.

1. The Recent Surge: What’s Happening in the Market

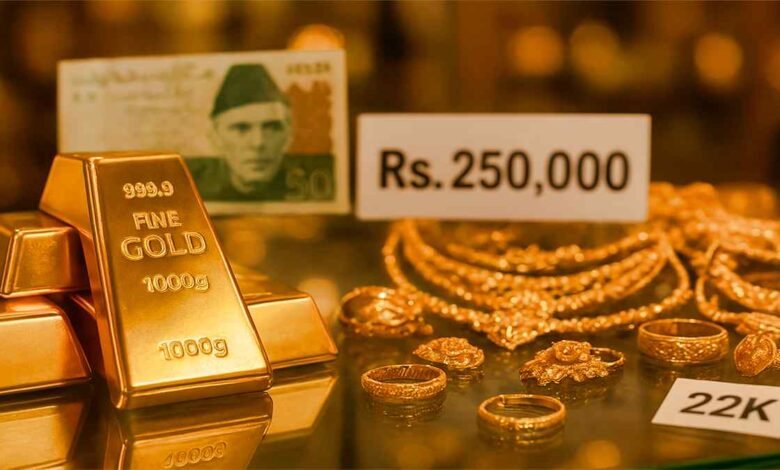

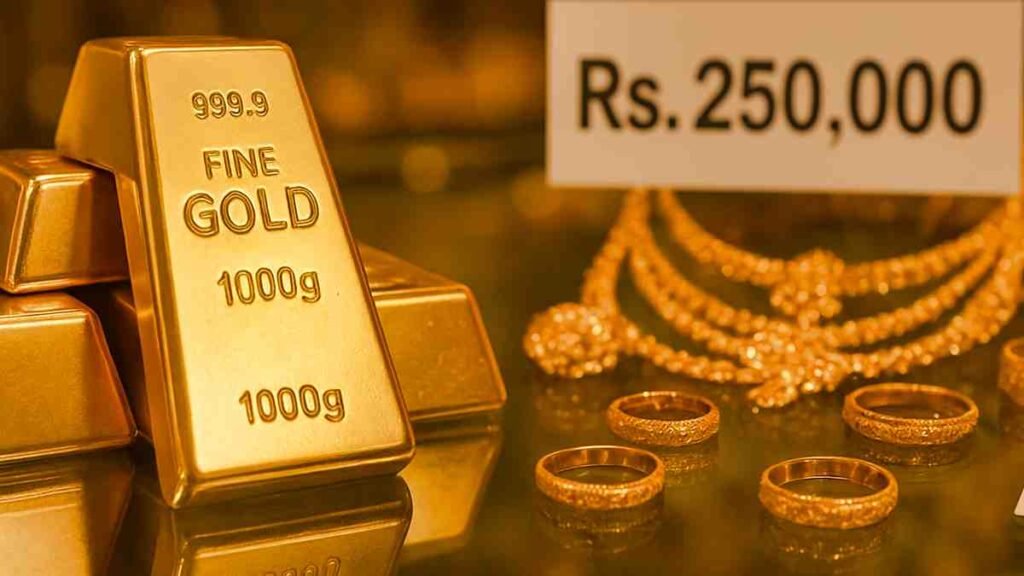

In October 2025, gold prices in Pakistan reached an all-time high, with 24-karat gold crossing Rs. 250,000 per tola in local markets. The upward trend isn’t isolated it mirrors similar spikes across global markets.

According to data from the All Pakistan Gems and Jewellers Association (APGJA), the per-tola price jumped by over Rs. 3,500 in just one week, marking one of the steepest increases of the year. This unexpected rise has prompted both excitement and anxiety excitement for those holding gold as an investment, and anxiety for those who depend on gold for weddings or savings.

2. Global Market Influence: The International Factor

Gold is traded globally, and international market dynamics directly affect local prices. When the U.S. dollar weakens or global inflation rises, investors often turn to gold as a “safe haven” asset.

In recent months, geopolitical tensions, rising oil prices, and fears of economic slowdown have driven international investors toward gold. The global gold rate has surpassed $2,500 per ounce, creating a ripple effect across developing markets, including Pakistan.

When global demand for gold rises, local prices inevitably follow especially in countries like Pakistan that import gold and rely heavily on international supply chains.

3. The Role of the Pakistani Rupee: Currency Depreciation

One of the key reasons behind the steep rise in local gold prices is the depreciation of the Pakistani rupee against the U.S. dollar.

Over the past year, the rupee has weakened significantly, making imported goods including gold much more expensive. For instance, even if the global gold price remains stable, a drop in the rupee’s value can cause domestic prices to soar.

Experts note that every 1% depreciation in the rupee can translate to a 2-3% rise in local gold prices, depending on import costs and market speculation.

4. Inflation and Economic Uncertainty: Gold as a Safe Investment

In uncertain economic times, gold is often seen as a hedge against inflation. With Pakistan experiencing rising inflation, reduced purchasing power, and limited investment options, many citizens are turning to gold as a safe and stable store of value.

Local investors prefer gold because:

- It holds long-term value despite currency fluctuations.

- It’s easily tradable and recognized globally.

- It provides a tangible alternative to volatile stock or property markets.

This growing demand further fuels price increases, creating a self-reinforcing cycle as prices rise, more people rush to buy, pushing them even higher.

5. Impact on Daily Life and Businesses

While investors benefit, ordinary citizens and small businesses are feeling the strain. Gold jewelry shops report a sharp decline in consumer buying, especially for wedding preparations.

A jeweler from Lahore noted,

“People are now buying lighter sets or switching to silver jewelry because gold has become too expensive for most middle-class families.”

Additionally, small gold traders struggle to maintain inventory levels, as high prices limit cash flow and reduce sales volumes. The situation is particularly challenging for rural markets, where gold traditionally plays a role in savings and dowries.

6. What Experts Are Saying

Economic analysts suggest that unless the rupee stabilizes and global tensions ease, gold prices are unlikely to decline soon.

According to Dr. Khurram Shehzad, a financial expert,

“Gold’s current rally is not just a short-term fluctuation it reflects deeper issues in currency management, import costs, and investor confidence. Pakistan’s gold prices will likely remain volatile through the end of the year.”

7. Looking Ahead: What Should Investors Do?

For those considering gold investments, experts recommend a cautious approach. Short-term traders should be prepared for price fluctuations, while long-term investors may benefit from gradual purchases rather than lump-sum buying.

In addition, digital gold investment platforms and mutual funds linked to gold may offer more flexible and secure ways to invest, without dealing with physical gold’s storage and purity risks.

Conclusion

The significant increase in gold prices in Pakistan is more than just a number it’s a reflection of global economic shifts, local currency struggles, and deep-rooted public trust in gold as a reliable asset.

While the surge has challenged consumers and traders alike, it also underscores the importance of financial awareness and diversification in uncertain times.

Whether the trend continues or stabilizes will depend on how Pakistan manages its currency and how the world navigates ongoing economic uncertainties.

For now, one thing is certain gold remains the shining mirror of Pakistan’s economic pulse.

3 Comments